OUR PRODUCTS

Precious Metals - Gold

Intermat is focused on trading 995 or 999.9 purity gold bars in 500gr or 1kg measurements.

As a well-established reputable supplier of precious metals, Intermat offers physical gold bars with 995 or 999.9 purity in bars measuring from 500gr. to kilogram or more. We supply jewelry manufacturers, wholesalers, banks and financial institutions and deliver “Good Delivery” bars from accredited refineries around the world. Our direct dealing access on multiple dealing platforms allows us to be constantly in touch and up to date with the latest global market trends and developments. and quote most competitive price.

Precious Metals - Silver

Intermat is focused on trading 995 or 999.9 purity silver bars in 500gr or 1kg measurements.

As a precious metals trader, Intermat offers physical silver bars with 995 or 999.9 purity in bars measuring from 500gr. to kilogram or more. We supply jewelry manufacturers, wholesalers, banks and financial institutions and deliver “Good Delivery” bars from accredited refineries around the world. Our direct dealing access on multiple dealing platforms allows us to be constantly in touch and up to date with the latest global market trends and developments. and quote most competitive price.

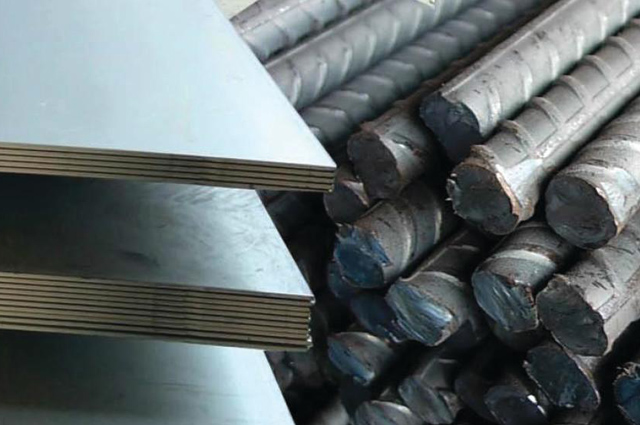

Base Metals - Steel

Intermat offers value added services for trading steel billets, slabs and sheets to any required international standard.

Having started its business as a base metal trader, Intermat offers steel billets, slabs and sheets to any required international standard. In this process we focus on using our knowledge and experience to add value and support our clients with any financing requirements they may have.

Petroleum Products

Intermat plays a relatively small role in trading petroleum products.

Intermat plays a relatively small role in trading petroleum products like petro chemicals, fuel oil and gas oil. Nevertheless it was among the first companies in the UAE to obtain United Nations permission to trade Iraqi crude in the food against oil program. We are able to offer products on a case by case basis.

Commodity Finance

Intermat is able to provide the physical and market infrastructure for commodity trade and has global access it easy to at all times of the day.

Intermat offers a bouquet of solutions to serve clients in multiple areas of financial management. As a member and active sponsor of the International Trade & Forfaiting Association (ITFA), we are integrated to a wide network of professional banks and financial institutions that enable the finance of trade around the world. Thus, we offer trade finance structuring and management as well as any other service related to trade finance. We provide risk management and liquidity through our trade finance facilities. We not only accept traditional payment instruments such as promissory notes, bills of exchange and documentary credits but also has embraced new instruments and created new structures to become a prominent part of supply chain finance.

Our Online Store

Intermat Corp now offers a seamless online shopping experience for gold, silver, and precious metals. Shop securely and invest with confidence – anytime, anywhere!